The Nature & Possibilities of A Decentralized Firm

In 1937, Ronald Coase, a British economist, published “The Nature of the Firm”, a seminal paper outlining the reasons that entrepreneurs…

In 1937, Ronald Coase, a British economist, published “The Nature of the Firm”, a seminal paper outlining the reasons that entrepreneurs form a firm and hire people to perform tasks, instead of simply contracting out to a specialist to perform said tasks. The central thesis of his paper was that there are numerous transaction costs to contracting out a task, including search and information costs, bargaining costs, and policing and enforcement costs, that can be avoided, or lessened, if performed by a firm. Coase suggested that entrepreneurs start firms when they can arrange to produce what they need internally and avoid the external costs. Prior to Coase, economists focused on understanding markets, so the focus on the firm was pretty revolutionary.

Why Decentralize

Just as Coase gave context to help people understand when it makes economic sense to form a firm, the crypto industry needs to give greater context to help people understand when it’s beneficial to form a decentralized organization.

I first started writing about FAMGA (Facebook, Apple, Microsoft, Google, and Amazon) and the impact of its growing concentration of wealth creation, in April of 2017 (“The Profound Implications of Five Increasingly Dominant Tech Companies”).

In a widely read post earlier this year title “Why Decentralizes Matters”, Chris Dixon highlighted how the growing domination of of GAFA (he left out Microsoft) was putting entrepreneurs at greater risk:

The bad news is that it became much harder for startups, creators, and other groups to grow their internet presence without worrying about centralized platforms changing the rules on them, taking away their audiences and profits. This in turn stifled innovation, making the internet less interesting and dynamic.

Chris graphically displayed the inevitable tensions that arise as platforms become more dominant, and the entire internet becomes more centralized.

So coupling the framework outlined by Coase, and the construct above, it makes sense to decentralize when growth of the platforms is decelerating, and the value extraction gets so significant, that it becomes greater then the costs associated with decentralization.

The Costs Of Centralization Vs. Decentralization

There are many areas where the costs to consumers/customers associated with centralization can potentially be lessened or eliminated by decentralization. These include costs that Coase did not consider including costs due to profit maximization, decreased privacy, and theft/seizure risk. There are also costs that Coase highlighted as being lessened by forming firms, which can be further lessened by decentralization. These include costs associated with bargaining and costs associated with policing/enforcement.

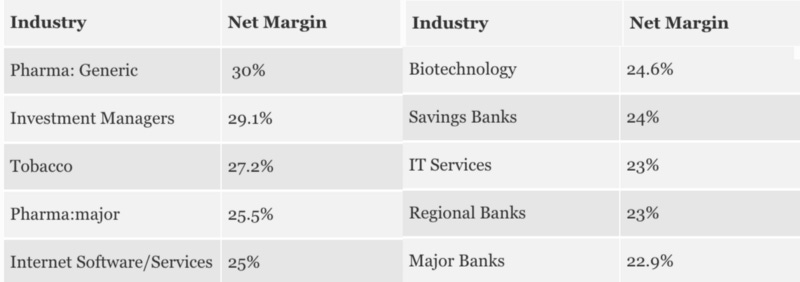

(1) On the cost due to profit maximization, one way to think of the value extraction, is profit margin. In other words, who is extracting the most profit by leveraging their position as a centralized company:

Source: Forbes

As a VC, the data above tells me that VCs (i.e. Investment Managers) who don’t adapt to this new world order are at risk of getting decentralized.

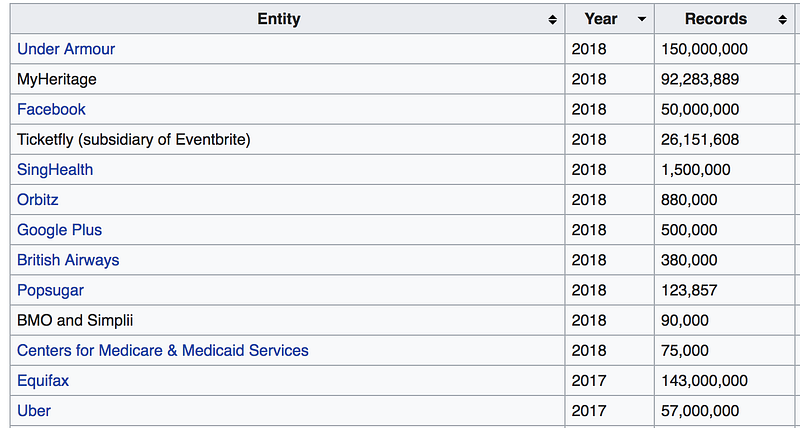

(2) There are multiple benefits to privacy of decentralization. Everyone is familiar with the hacking and theft of our data when it’s centralized:

Source: Wikipedia “List of data breaches”

While the number of companies getting getting hacked is alarming, it pales in comparison to the number of companies that are simply selling our data, selling our privacy, as part of the normal course of business. While many people have accepted and appreciate the fact that “if you’re not paying for the product, you’re the product”, many people don’t appreciate the extent to which their private data is sold whether they pay for the product or not. How many people appreciate that 23 & Me and other DNA testing companies sell your genetic data? It doesn’t get more personal then that.

(3) Your privacy and assets are often at greater risk of of seizure when they’re centralized. We all know the government can track our whereabout via our cell phones by seizing the data from the centralized wireless providers. We all know our Bitcoin is more at risk of theft from a centralized exchange like Mt. Gox then a decentralized exchange.

(4) Costs associated with bargaining could be lessened by the use of “pervasive markets” which are always transacting at agreed upon/pre-determined prices (e.g. projects that use bonding curve). A great example of this, that is caling in the wild, is Bancor, which provides algorithmic market making.

(5) policing and enforcement costs can be greatly reduced or eliminated by the use of smart-contracts. I gave an example of this wrote in “My Favorite Blockchain Application.”

So, all else being equal, it makes sense to decentralize when you can lower costs significantly, or if the user concern over privacy, theft, or seizure is high.

Decentralizing To Give Users New Benefits / Leverage New Possibilities

I actually believe that the greatest reason to decentralize may be to benefit from the new business processes that are now available given the advent of technologies like blockchain, cryptocurrency, smart contracts, and zero knowledge proof. Now we can incentivize users and leverage communities in ways we couldn’t before. We now have the ability to totally rethink what a firm is and how a firm operates.

The tools give us new ways to incentivize customers and other members of a decentralized firm’s ecosystem. In my last FAMGA post, “The Coming Epic Battle Between Crypto & FAMGA”, I posited that the ability to leverage a “community” is the potentially the best weapon that decentralized entities have against entrenched competitors, and thus a great reason to decentralize.

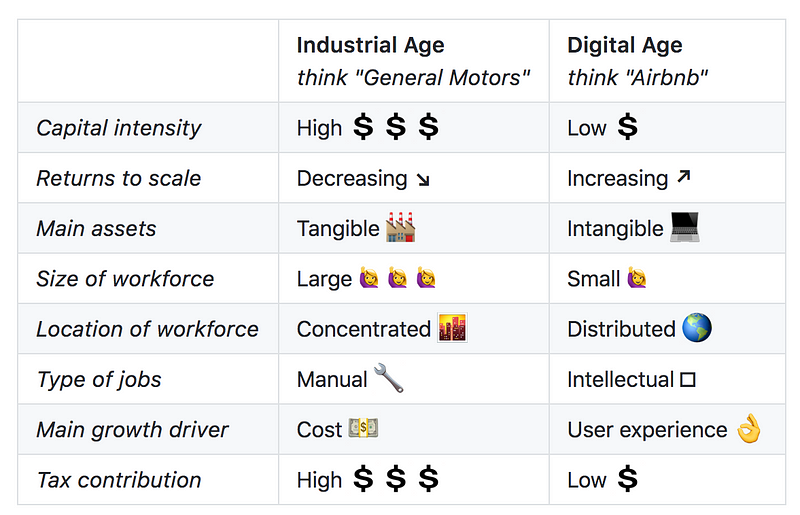

thibauld Favre recently wrote a super interesting piece titled “Introducing Continuous Organizations” where he highlights how the very nature of a firm has changed in the digital age:

But the legal structure of the firm has not evolved in tandem. Thibauld argues that by utilizing a continuous organization structure :

…organizations can set themselves in continuous fundraising mode while benefiting from solid and flexible mechanisms to align stakeholders’ interests in their financial success.

A detailed white paper is available here.

Continuous Organization may be the future of the firm. Maybe the future is Partially Decentralized Organizations (by Matt Lockyer). They may be, but the bigger point is the infinite decentralized organization and processes we can imagine with these new technologies.

The Benefits Vs. The Costs Of Decentralization

While we’ve outlined the costs of centralization above, we must recognize the costs of decentralization. In my view, the biggest cost today is the lack of a viable governance model enabling a decentralized entity to evolve along with an evolving world. Luckily firms like DAOstack and Aragon are trying to solve for that.

We are also early in the design of functional token economic models. We’ve seen some progress in token economics design from companies like Prysm Group and Props Project, as outlined in this post, but we’re early in terms of implementation and improving.

Conclusion

Coase posited that entrepreneurs start firms “..when they can arrange to produce what they need internally and avoid the external costs”. The digital age has already addressed some of these costs (e.g. search and information cost have been reduced dramatically). Decentralization holds the promise of lessening or eliminating many other costs, while enabling significant new benefits from “community.”

So while the price of crypto is imploding, it’s important to recognize how decoupled the price is from crypto’s progress and possibilities. It’s an incredibly exciting time to be in crypto and thinking about how to make the world a better place, because the possibilities have never been so endless.

If you got at least 0.00000001 Bitcoin worth of value from this post please “Clap” below so others will see it.